A Modern Excess Profit Tax

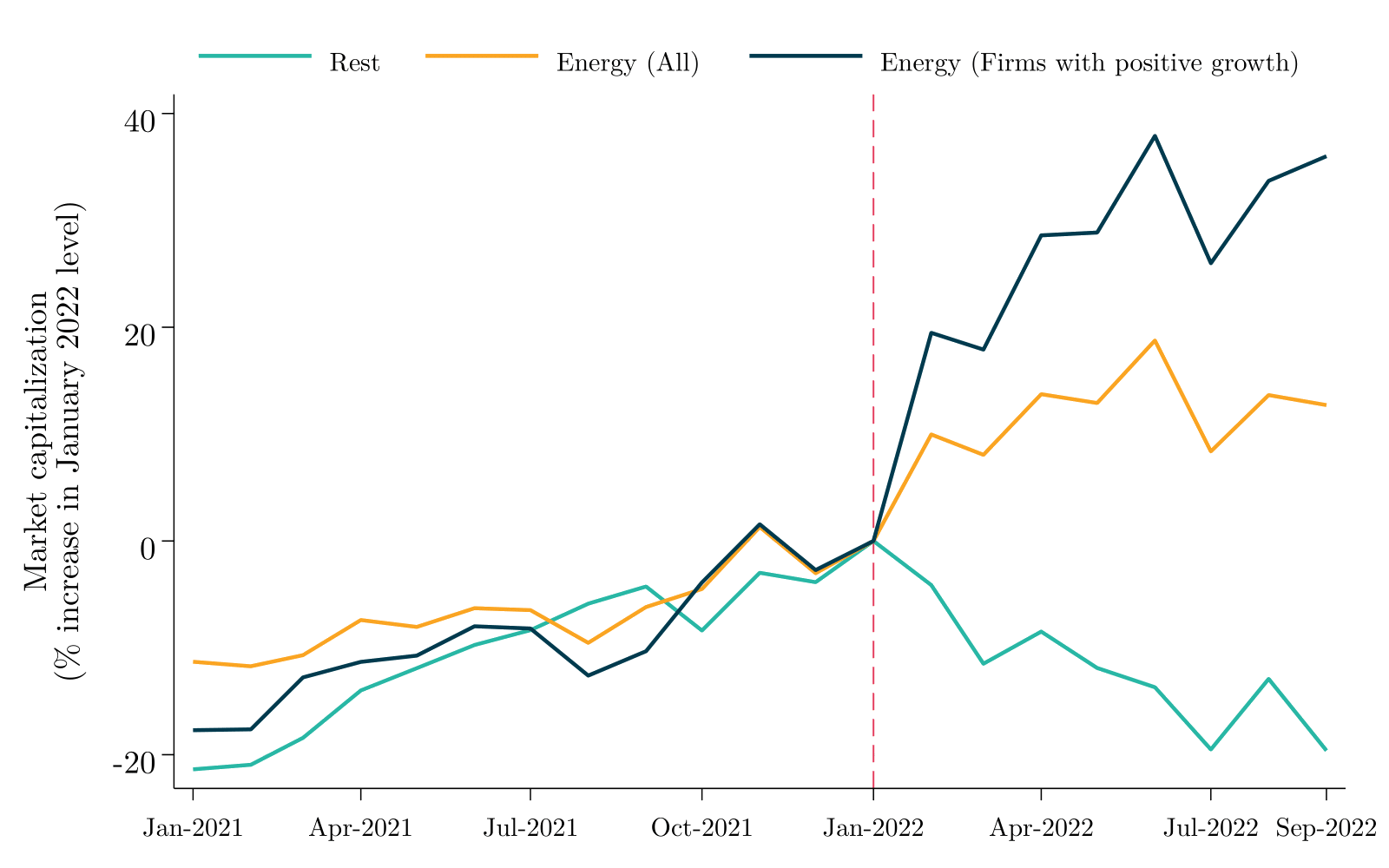

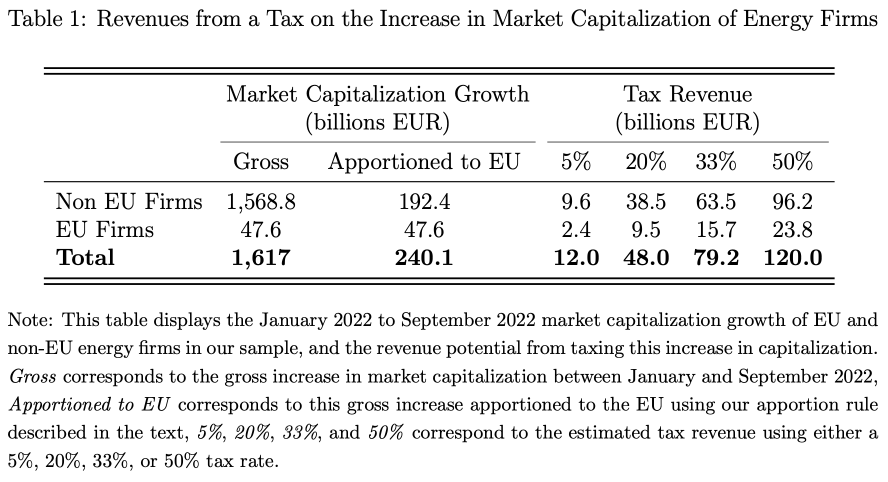

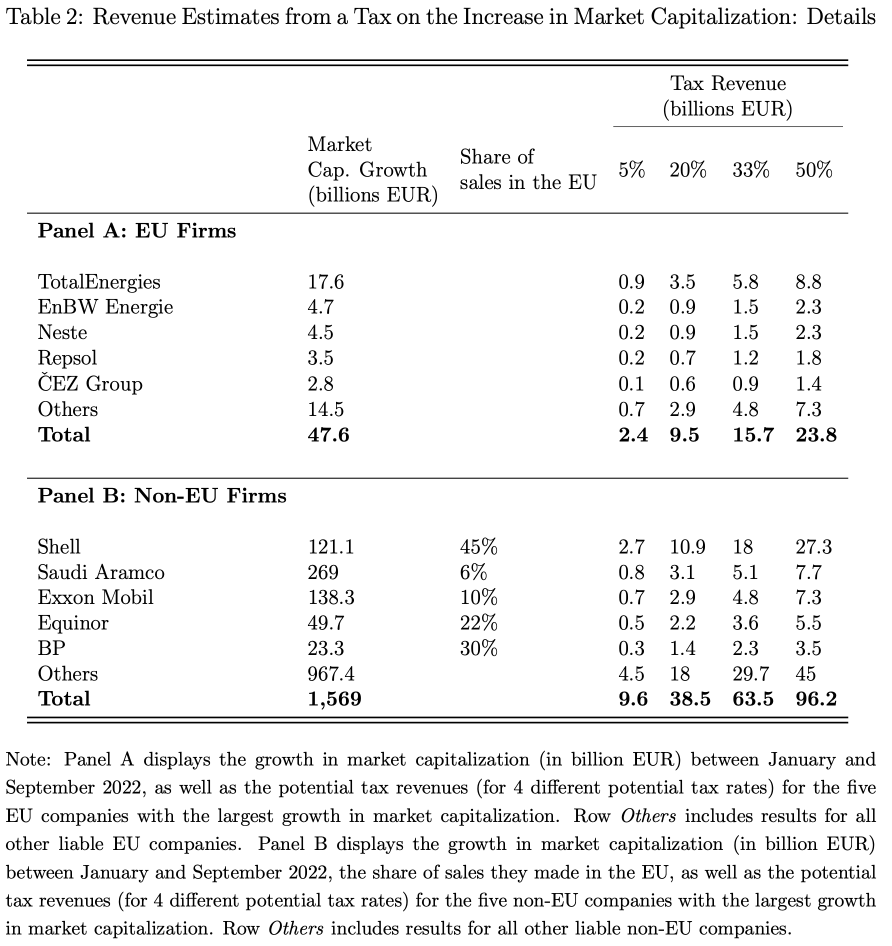

The invasion of Ukraine by Russia in February 2022 and the ensuing war have brought hardship to the global economy, and to the economy of the European Union in particular. Energy companies , however, have largely benefited from it. We propose a modern way to tax the excess profits of the energy industry by targeting increases in market capitalization. This would make the tax much harder to avoid than standard excess profit taxes, and would allow to capture rents irrespective of where multinational companies book their profits. We estimate that with a tax rate of 33% the European Union could collect around €80 billions in revenue.

Advantages of our Proposal compared to Standard EPT

- Easy to enforce and prevent tax avoidance

- Market capitalization is easily observable and hard to manipulate

- Meanwhile, profits can be shited to tax havens: 36% of profits made by firms in countries other than their headquarters' are shifted to tax havens

- Capture all rents earned by energy firms

- Target both “upstream activities” (oil and gas exctraction) and “downstream activities” (refining, etc.)

- Minimize risks of making EU firms less attractive

- Target both EU and non-EU firms. Non-EU firms should pay in proportion of the sales they make in the EU

It is often in time of war that innovative tax instruments have been developed. The one we propose responds to the specific circumstances of the current crisis, and to the practical challenges of taxing multinational companies in a globalized world.